Una residencia sofisticada e impresionante enclavada en el pintoresco paisaje de la parte baja de Nueva Andalucía. Distribuida en dos plantas, presenta amplios ventanales y acogedoras terrazas que invitan a disfrutar de las impresionantes vistas de La Concha y el Mediterráneo.

Al entrar en la propiedad, un acogedor patio brinda acceso tanto a la villa principal como a una casa de invitados separada, completa con su propia terraza y ducha al aire libre, un entorno ideal para momentos compartidos y retiros privados. Al cruzar la puerta de entrada de la villa, los huéspedes son recibidos por un amplio vestíbulo que marca el camino para descubrir el resto de la casa. En este nivel, esperan un baño de recepción, el dormitorio principal y un segundo dormitorio en suite.

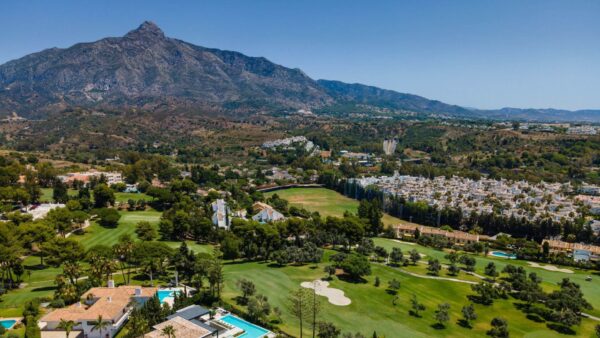

Una escalera minimalista desciende al piso inferior, donde la sala de estar, el comedor, la cocina, un dormitorio adicional y un baño se despliegan a la perfección. El espacio habitable se abre a una terraza con una piscina infinita de mármol, que ofrece un lugar tranquilo para admirar las vistas a la montaña.

Con sus líneas limpias y su diseño versátil, ofrece la flexibilidad de configurar el espacio para adaptarse a cualquier estilo de vida, ya sea que prefiera cinco habitaciones o desee transformar una en una sala de cine, gimnasio u otro espacio creativo.

Cada detalle dentro de la villa refleja un compromiso con la sofisticación y la comodidad. Materiales nobles como el mármol y la madera se combinan en una paleta etérea, creando una atmósfera de elegancia atemporal. La calefacción por suelo radiante garantiza calidez durante los meses de invierno, mientras que el aire acondicionado central proporciona alivio en los calurosos días de verano.

Situada a poca distancia de Puerto Banús y la playa, así como de prestigiosas escuelas, empresas y el puerto deportivo, esta casa ofrece más que una residencia: es una invitación a abrazar la vida en el paraíso.

Nueva Andalucía es una zona exclusiva al pie de la cordillera de Sierra Blanca, una de las zonas residenciales más buscadas de la Costa del Sol, ubicada justo al lado del mundialmente famoso e icónico Puerto Banús, con su lujoso puerto deportivo con boutiques de diseñadores, y una animada vida pública todo el año. Próspera zona residencial con elegantes villas y apartamentos de lujo. También conocido como El Valle del Golf, Nueva Andalucía es el lugar ideal para los campos de golf costeros más prestigiosos, incluido el Real Club de Golf Las Brisas, Los Naranjos Golf Club, Aloha Golf Club.

Si tiene alguna pregunta, necesita más información o desea saber cómo podemos ayudarle, no dude en ponerse en contacto con nosotros. Rellene el siguiente formulario y nuestro equipo se pondrá en contacto con usted lo antes posible.

Recibe actualizaciones exclusivas sobre propiedades, tendencias del mercado y consejos directamente en tu correo. ¡Sé el primero en descubrir las mejores oportunidades!