GOLF – The keys to the success of the Costa del Golf

The keys to the success of the Costa del Golf

Why do golfers choose the Costa del Sol to enjoy their favourite sport? This and many other important questions analysing the motives of this key group of travellers are answered in an exhaustive study carried out by the Costa del Sol Tourism governmental body, which also underscores the golf industry’s economic repercussions in this premier tourist destination.

Why do golfers choose the Costa del Sol to enjoy their favourite sport? This and many other important questions analysing the motives of this key group of travellers are answered in an exhaustive study carried out by the Costa del Sol Tourism governmental body, which also underscores the golf industry’s economic repercussions in this premier tourist destination.

The study report was recently presented officially by the president of Costa del Sol Tourism and the Diputación Provincial de Málaga (regional parliament), Elías Bendodo, accompanied by the president of the Royal Andalucia Golf Federation, Pablo Mansilla.

One piece of data especially worth highlighting is the fact that, according to the study, “golf’s impact on the Costa del Sol is valued at €1,410 million in direct and indirect production, and €775 million in direct or indirect revenue”.

“To gain an idea of this sector’s relevance,” noted Bendodo, “the average amount spent by a golf tourist is more than €1,800, for an average stay of 12.31 days.”

The study also revealed, he added, that golf tourism had become one of the Costa del Sol’s main ambassadors, with the Coast home to 67 percent of the total number of courses in Andalucía and having more courses than any other provincial area in Spain (69).”

Bendodo emphasised the effect this segment had on creating employment, “with nearly 17,700 jobs, either direct or indirect”. The study covered the area known as the “Costa del Golf”, which includes Málaga province and the Sotogrande area at the eastern end of Cádiz province.

Golf courses on the Costa del Sol

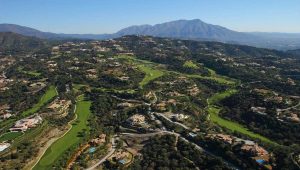

After outlining the current golf situation in Europe – more than four million golfers officially registered with their respective federations, over seven million active golfers in total and approximately 7,000 golf courses – the study focused on golf facilities on the Costa del Sol. Along this stretch of coastline, from Vélez Málaga in the east to San Roque in the west, there are a total of 69 golf courses, with 1,134 holes distributed across 16 municipalities.

The Costa del Golf has 67 per cent of the golf courses in Andalucía: that is, more than two out of every three courses. On the Costa del Golf, 49 golf courses offer 18 holes (seven out of every 10 of the total number of courses).

The nine-hole courses represent 23.2 percent of the total number, or 16 courses in absolute figures. Less common are the 27-hole courses, with only four, accounting for 5.8 per cent of the destination’s total.

The 69 courses are distributed across 16 municipalities, with more than half the Costa del Sol/Costa del Golf’s courses and holes concentrated in Marbella, Mijas and San Roque.

Marbella is the leading municipality, offering 15 courses and 243 holes, which represents more than 20 per cent of the total offer.

Mijas, with more than 17 percent of the total, has 12 courses and 189 holes; and San Roque (which takes in the Sotogrande macro-urbanisation) has nine golf courses (eight of 18 holes and one of 27 holes – or 13 percent of the courses and more than 15 percent of the holes).

Estepona and Benahavís are the municipalities with the next highest concentration of golf courses, eight each, or 11.6 per cent of the courses on the Costa del Golf.

Benahavís offers a greater number of holes, as it has eight 18-hole courses and only one nine-hole course, making a total of 135 holes and representing almost 12 per cent of the offer.

Estepona has five 18-holes courses and three nine-hole courses, 117 holes in total and 10.3 per cent of the overall offer.

They are then followed by Málaga, Benalmádena and Casares with three courses each, or 4.3 per cent of the destination’s courses.

Malaga offers a greater number of holes, with one 27-hole course, another 18-hole course and a third course with nine holes, making a total of 54 holes and representing 4.8 per cent of the offer.

Alhaurín de la Torre, Vélez Málaga, Rincón de la Victoria, Antequera, Manilva, Torremolinos and Ojén have one course in each of their respective municipalities.

Fifty per cent of the municipalities offering golf courses represent 11.6 percent of the courses (eight) and 11.9 percent of the holes (135).

Golf Tourism Demand

Golf tourism on the Costa del Sol is led by the United Kingdom, followed by Scandinavia, with France and Germany also of great importance.

Most of the “golf tourists” on the Costa del Sol/Costa del Golf – that is to say, tourists whose main motivation during their trip is to enjoy playing golf – come from these markets.

In a second rank of importance are tourists from Spain, Holland, Portugal and Ireland; and in third place the markets of Belgium, Switzerland and Italy.

The employment situation of golf tourists who visit the Coast is quite polarised. There are two categories: people who are in work or those who are retired. The other options are practically non-existent.

Tourists who are employed, including those who are self-employed, account for about four out of five of the total number of tourists who visit with the intention of playing golf, namely

79.8 per cent of the total.

Over half (57.6 per cent) of the golf tourists interviewed who had visited the Costa del Sol/Costa del Golf declared themselves to be users of social media (either daily or occasionally). One out of every five golf tourists said they used social media on a daily basis. However, about two out of five used it occasionally.

“Travelling with friends” was the main form of travel for golf tourists on the Costa del Sol/Costa del Golf, as stated by about four out of 10 of the tourists interviewed.

Travelling “as a couple” followed very closely, as the second most popular way for golf tourists to travel to this destination, as indicated by more than one in three respondents.

Golf tourists who visited the destination Costa del Sol/Costa del Golf had an average expenditure for their trip of €1,827.29, which meant an average daily expenditure (including transportation, accommodation and spending at the golf course) of €148.46 per day. On the days they played golf, the average daily expenditure rose to €205.61.

Golf tourists were asked, in addition to playing golf, what other specific motivation they had to make this trip to the Costa del Sol.

Their enjoyment of sun and the beach remained the main leisure motivations for choosing the destination, indicated by seven out of 10 golf tourists interviewed.

The second motivation, in terms of importance, was the desire to “enjoy the leisure offer and recreational activities”.

The most common length of stay corresponded to those golf tourists who remained on the Costa del Sol for four to eight days. This applied to about four out of 10 tourists.

In second place were those who stayed in the destination for nine to 15 days, which applied to almost three out of 10 tourists interviewed. The longest stays, from 16 to 30 days, represented more than one-fifth of the responses, followed by stays of more than 30 days.

The golf tourist who visits the Costa del Sol/Costa del Golf is highly active and dynamic. Apart from playing golf, the activity most commonly undertaken by these tourists involves visits to historic and natural areas, as indicated by more than four out of 10 tourists interviewed.

Decision factors for the choice of the destination

More than three-quarters of the tourists interviewed highlighted the weather as a decisive factor when choosing a destination.

Next in importance were loyalty to the destination and the diversity of leisure opportunities offered by the Costa del Sol/Costa del Golf. A third block of key factors identified by tourists when choosing Málaga as a golf destination included visits to friends and family, the diversity of the offer that exists, attractive resources and recommendations.

Golf tourists who visited the Costa del Sol/Costa del Golf used the internet as their main source of information for finding out about the destination’s golf facilities – more than half of the golf tourists interviewed. Fewer than five per cent of the respondents stated that they had consulted the website visitacostadelsol.com. Next followed travel agencies, mentioned by about one in three of the tourists interviewed.

Evaluation of the Destination

Golf tourists gave the Costa del Sol/Costa del Golf an average rating of 9.24 out of 10 as a destination. The most valued aspect was personal security, followed by service and treatment received during their visit, taxi and train services, value for money, tourist information available, and leisure and entertainment options, all receiving scores of 9.24 or higher, the destination’s average score.

In the second group of most valued aspects were shopping, available accommodation, beaches and their facilities, and urban environment, with ratings higher than 9.0 points. The high scores these tourists gave to other aspects should also be noted: road signs, catering, accessibility, car hire, bus services and access to the destination. These were all given scores of higher tan 8.17 out of 10.

Also worth highlighting is the high degree of recommendations, with 98.7 percent of the tourists interviewed saying they would recommend the Costa del Sol/Costa del Golf as a golfing destination.

Golf tourists also showed an exceptional degree of satisfaction with their experience on the Costa del Sol/Costa del Golf.

More than nine out of 10 golf tourists interviewed rated their stay on the Costa del Golf as very satisfactory and close to 4.3 per cent as positive. The “as expected” degree of satisfaction was 1.2 percent of the total number of golf tourists interviewed, with no respondents giving rankings of “negative” or “very negative”.

High Intensity Tourism

Following are the main results of an analysis of “high-intensity” golf tourist” demand on the Costa del Sol/Costa del Golf, defined as that tourist who indicates playing golf to be the main and determinant motivation to visit the destination, and in addition plays a round of golf on two or more of every three days spent in any of the municipalities of the Costa del Sol/Costa del Golf.

– High-intensity golf tourism on the Costa del Sol/Costa del Golf is led by the international market, representing about 85 percent of these tourists

– Three out of 10 of these golfers who came to the Costa del Sol/Costa del Golf were 60 or older; the average age of tourists classified as “high-intensity” was 51.2 years.

– The most common intervals of stay were four to eight days, followed by stays of nine to 15 days, which means that the average stay of these golf tourists who visited the Costa del Sol/Costa del Golf was 7.02 days.

– High-intensity golf tourists who visited the Costa del Sol/Costa del Golf had an average daily expenditure, including transportation, accommodation and spending at the golf course, of €198 per day.

– On the days when these tourists played golf, the average daily expenditure was higher, reaching €231 per day.

– In addition to playing golf, other attributes that motivated them to choose the destination Costa del Sol/Costa del Golf for their trip was to enjoy the sun and beach, indicated by more than eight out of 10 tourists, followed by the desire to “enjoy the leisure offer and recreational activities”, as well as cultural motivations.

– Hotels were the leading type of accommodation among these high-intensity golf tourists, an option chosen by about three out of four tourists interviewed, four-star hotels being in greatest demand, followed by five-star establishments.

– The weather, loyalty to the destination and the diversity of leisure opportunities were, in that order, the decisive factors for high-intensity golf tourists when choosing the destination.

– Golf tourists showed a high degree of satisfaction with their experience on the Costa del Sol/Costa del Golf. More than nine out of 10 golf tourists interviewed rated their stay on the Costa del Golf as very satisfactory.

– They awarded the Costa del Sol/Costa del Golf an average score of 9.2 out of 10.

– The most valued aspect was the service and treatment received, followed by personal safety, leisure and entertainment opportunities, beaches and their facilities, value for money and shopping.

– High-intensity golf tourists displayed high levels of loyalty to the destination. Nearly eight out of 10 planned to return to the Costa del Sol in the next three years and 16 per cent said that “perhaps” they would return.

– The high-intensity golf tourist played golf an average of 4.6 times during their stay in the destination (estimated over seven days).

– These golf tourists said they took an average of 4.7 golf trips a year, most trips taking place in October, February, November and March (in that order).

Qualitative Analysis of Internal Agents

An analysis of the opinions of a representative sample of internal agents (businesspeople, professionals and public officials from the Costa del Golf) led to the following conclusions being drawn…

Strategic Markets

Scandinavia was reported to be the leading strategic market for the future, followed by the UK and Germany. Ranked in third place were the eastern European countries, France and Ireland. Other interesting markets were Spain, Holland, Switzerland and Belgium.

Interesting Products

The experts interviewed indicated that the destination must be able to guarantee an ability to play golf and to enjoy excellent food and wine. They also agreed in highlighting the importance of selling the golf destination together with the Costa del Sol/Costa del Golf’s complete leisure and fiesta options. Other attractions linked to golf and considered of great interest for this segment’s profile were culture, health and beauty, luxury establishments and accommodation facilities. They also indicated that it was of interest to design products for senior golf tourists who enjoy long stays. This is a strategic segment, given the greater availability of time and money that they have.

Main Advantages

When asked about the reasons why the Costa del Sol/Costa del Golf had comparative advantages over its competition with respect to the golf segment, the answers were…

Essentially, the weather – the first reason given by a large majority.

In second place, they indicated the destination’s wide range of complementary options, with the variety of nightlife, leisure and cultural activities, as well as the volume and concentration of golf courses offered by the Costa del Golf.

In third place were such aspects as the quality of services and facilities, the availability of an international airport with connections to more than 125 destinations, security, infrastructure and good communications.

In fourth place were other advantages such as value for money, wide range of hotels and other types of accommodation, and being a well-consolidated destination.

Satisfaction with the Quality of Services

Another interesting aspect was the opinion of businesspeople, professionals and public officials about the main services related to golf tourists.

There was a high perception of the leisure and recreation options complementary to golf, followed by gastronomy and the wide range and high quality of hotel accommodation, all of which received ratings of over eight out of 10.

Secondly, with notable scores between seven and eight out of 10, were the city environments and the quality of the courses and their facilities, together with the cultural options, service and treatment, and quality/price ratio.

Finally, although with relatively low scores, came rental accommodation and the pace of a round out on the course, both below seven.

Qualitative Analysis of External Agents

An analysis of the opinion of a representative sample of external agents (foreign tour operators working with the Costa del Golf) revealed the following conclusions…

Golf Tourist Destinations That Sell

The Costa del Sol/Costa del Golf is currently the main golf destination working with the agents and external operators interviewed.

In fact, all the agents interviewed stated that they worked with the Costa del Golf destination, but not all with the same intensity. Nearly a quarter of the interviewees positioned the Costa del Golf as their main destination; 31 per cent as the second most important; and the rest, about half (46 per cent), in lower positions.

The Algarve in Portugal was the second most important destination for international agents, indicated by about eight out of 10 respondents. About half of the agents who indicated the Algarve positioned it as the main or second most important destination in their portfolio. In third place were the island destinations of Spain – the Balearics and Canary Isles – and the rest of Portugal, each indicated by a third of the interviewees. Morocco, the Costa Blanca, Scotland, Mauritius and the Costa de la Luz all occupied a prominent place, indicated by about a quarter of the agents interviewed. They were followed by the Costa Brava, Murcia, Italy, Belek in Antalya, Ireland and the French Riviera, mentioned by a 10th of the interviewees.

Interesting Attributes

Faced with the question of which Costa del Golf attributes were most interesting for this segment and its future competitiveness, experts interviewed indicated that it was necessary to guarantee the ability to play golf and to be able to enjoy excellent food and wine options, as indicated by nearly two out of three respondents. They also agreed in highlighting the importance of selling the golf destination together with the Costa del Sol/Costa del Golf’s complete cultural offer, as indicated by about half of the interviewees.

Linked to golf, other attractions of great interest for the profile of this segment were the wide range of leisure, fiesta and health and beauty opportunities, indicated by around a third of respondents; followed by shopping, inland areas and nature, the beach and enjoying the magnificent weather.

They also indicated that it was of interest to design products for business tourists (MICE) and golf for older couples.

Other attractive attributes were the destination’s extensive complementary options and, for long-distance travellers from countries including Japan and Canada, authentic Andalusian traditions.

Satisfaction with the Quality of Services

There was a high perception of the leisure and recreation options complementary to golf, followed by gastronomy and the wide range and high quality of hotel accommodation, the atmosphere of the cities and the quality of the courses, all of which received ratings of more than eight out of 10.

Secondly, with notable ratings between seven and eight out of 10, were the quality of golf course facilities, the cultural options, the service and treatment, the quality/price ratio and the available rental accommodation.

Finally, although with a relatively low score, the pace of play was mentioned, with a rating of 6.8.

Forecast of Golf Tourism Activity in 2021

In general, for the year 2021 the operators anticipated an increase in their activity with the Costa del Sol/Costa del Golf well above the sector’s global average.

They estimated growth of 6.3 per cent in overall evolution of golf activity in 2021, compared with 18.5 per cent on the Costa del Sol.

Economic impact of golf tourism on the Costa del Sol

Depending on the method of calculation, the number of tourists ranged from 501,400 to 516,000, so to estimate the number of tourists who visited the Costa del Golf the study authors took an average. It was therefore estimated that during 2016 the number of golf tourists reached 508,700 tourists.

Estimate of Tourism Expenditure

The average daily expenditure of the golf tourist was €148.40, which included the cost of transport to the destination, accommodation, catering, food purchases, non-food purchases, transport at the destination, cultural or leisure expenses, green fees, buggy and club hire, other expenses related to golf, etc.

In addition, as indicated in the section on analysis of demand, they stated that on average they stayed for 12.3 days, so the average expenditure per tourist was estimated at € 1,827.

Impact on employment

It was estimated that this expenditure generated about 17,700 jobs. Of these, 10,580 were direct jobs and the other 7,100 were generated indirectly or induced.

The sectoral distribution of this impact reflected a higher incidence in the most labour-intensive sectors, such as hospitality (35.9 per cent), shopping (30.7 per cent) and sporting, cultural and recreational activities (13.1 per cent).

If you are interested in property in or near golf courses in Marbella and the surrounding area, type

GOLF PROPERTIES to visit this section.